Golf community homes are on fire in the South. No, not forest fires but hot market fires, the kind that come along once in a generation when the gulf between supply and demand seems like an ocean. That is the topic this month, with some thoughts about strategies for retirees considering a move.

Golf Club of Avon, Avon, CT

Golf Club of Avon, Avon, CT

Retiree Dilemma: Which Road to Takeon the Path to Your Dream Golf Home

The famous philosopher Lawrence Berra, aka Yogi, allegedly once said that, “When you come to a fork in the road, take it.” That pretty much sums up the dilemma faced by millions of Baby Boomers and others considering a move to a warm climate with a low cost of living. The sign on one fork points “This Way.” The sign on the other says “Stop Here.” Both choices, the only two available to those who have been planning to move in retirement, involve risk.

Real Estate Market: Too Hot to Touch?

Covid-19 has had a devastating effect on the lives of millions and has pretty much thrown the world economy into a tailspin. Many businesses that depended on walk-in trade have been shuttered, and many more are on the brink. But two industries have not only survived but also, for the most part, thrived in ways they have not seen for more than a decade — the golf industry and the real estate industry.

Golf’s unique ability to provide recreation at an easily achieved social distance has made it a safe haven for golfers. And real estate sales have exploded, especially in areas at a distance from cities where the pandemic is at its most deadly and intimidating. And where golf and real estate are combined in warm and low-cost-of-living climates, homes are selling at historic levels.

A market environment in which prices in the most favored golf communities in the Sunbelt increased by double-digits in 2020 might argue for a watch and wait approach. After all, the laws of physics — and markets — say what goes up must come down. But the incontrovertible laws of real estate say also that when supply is low and demand is high, prices rise, and dramatically so when the delta between the two is wide.

Golf Communities on Fire

And boy is that delta wide as I write this. A few examples should suffice. Last year, in Murrells Inlet, SC, home to Wachesaw Plantation and other popular golf communities south of Myrtle Beach, the supply of single-family homes for sale dropped by almost 33%, and in December, just 3.3 months’ worth of homes were on the market. A six-month supply is considered “healthy” by real estate industry experts. At the Grand Harbor community on Lake Oconee in Greensboro, GA, the 13 homes currently listed for sale are about half the number typically for sale historically. A little farther up the lake at Reynolds Lake Oconee, I was surprised to see recently just seven homes listed for sale; in 2019, there were dozens. But as if to demonstrate the point that the rush is on for golf homes, another seven single-family homes at Reynolds were listed as “under contract.”

At Cypress Landing in Chocowinity, NC, Dave Grahek, a member of the marketing committee of the property owner’s association board, reported that just 10 homes were for sale in the community at the end of December compared with a five-year annual average of 28. And as I have reported before, late last year the Keowee Key community on Lake Keowee in rural South Carolina reported that many homes were selling over list price and some bidding wars had erupted. A few days ago, I noted Keowee Key listed just four homes for sale under $750,000, about 1/10th of its typical inventory.

Demand for the relatively few homes for sale in Brunswick County, NC, as local Realtor Doug Terhune put it in his February newsletter, is “on fire.” New listings across the county in just the month of December 2020 were up a decent 13.6% over same-month numbers in 2019, but units sold exploded by 45.7% to a total of 577. Average selling price was just under $372,000 and the total sales volume in the county increased an amazing 65.7%, to over $214 million — in one month. That certainly meets the definition of “on fire.”

And lest anyone think it is just the lower and mid-price ranges generating the most sales, I received a report a few days ago from Kiawah Island Real Estate indicating the island, home to some of the highest priced real estate in the South, had its “strongest year of real estate sales in [its] history.” Total sales volume on the island increased 169% over 2019 figures and, not surprising, “island wide inventory is the lowest on record.” That record goes back to Kiawah Island’s first sales in 1976.

The Fork That Says “Wait”

With prices rising rapidly in the most popular golf communities in the South, which fork in the road is a retiree or near-retiree couple supposed to take if they have been counting on a relocation to the warm South?

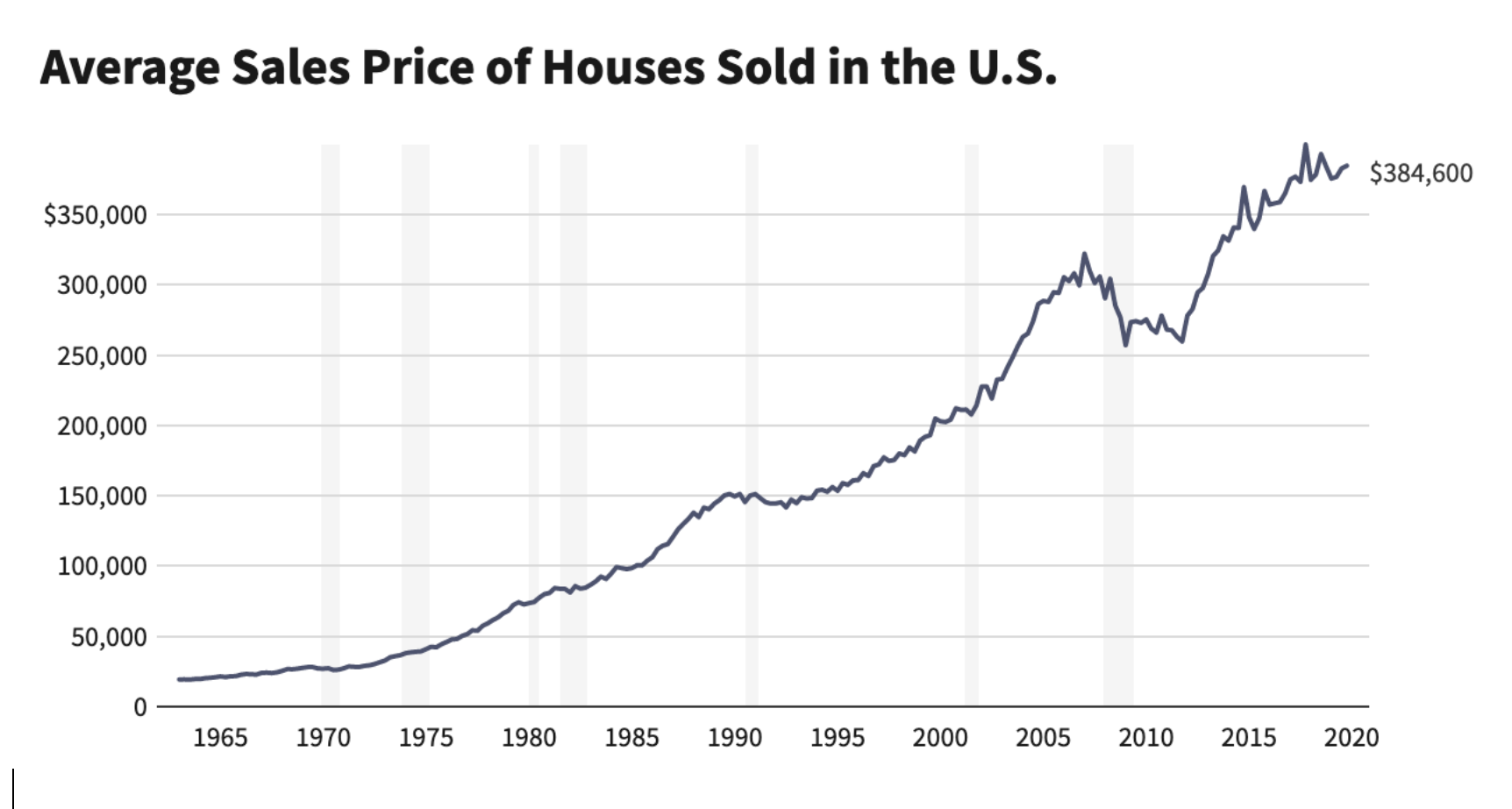

Waiting to see if the markets in the Sunbelt cool down is certainly a strategy, but it carries the greatest risk. The well-advertised notion that “past performance does not guarantee future results” may have you thinking those prices can’t keep rising at their current rates. A market correction must be in the offing, right? But the history of real estate market pricing shows that it will take pretty much an economic catastrophe to readjust prices enough to make waiting an effective strategy. The attached chart from the Investopedia website illustrates that; it shows only one significant (years long) interruption, from the beginning of 2007 to the end of 2011. Other than that, average real estate prices for homes in the U.S have risen pretty much in a straight line, from $19,300 at the beginning of 1963 to nearly $385,000 at the end of 2019.

If we encounter another major recession that readjusts home prices in golf communities, the financial lives of retirees planning to relocate will suffer in ways both related and not related to home affordability. (Think about the effects of a recession on IRAs or other investments that normally help fuel purchase of a retirement home.) And, anyway, if such a recession did not arrive for a few years, prices may have risen too much to retreat quickly enough for those who have waited. During the 2008 recession we saw prices across the South decrease by as much as 50%; they fully rebounded to pre-recession levels in about five years. Question for retirees who choose to wait: Do you want to wait five years just to get back to the price of a home you could purchase today?

The Fork That Says “Go”

An alternate strategy is to buy now, even if the price tag is higher than you planned — maybe even 20% higher (although buying a little less house is a viable strategy too). In golf communities I follow, the lowest-priced homes a few years ago have risen at the fastest rate generally. For example, at Reynolds Lake Oconee, homes were priced in the $200s and $300s from just after the recession until mid 2020 when the lowest level rose into the $400s. As I write this the first week in February 2021, the lowest priced home for sale not currently under contract in Reynolds is listed at $629,000, and there are only two others priced under $1 million.

If that $629,000 price follows the trend of the past few years, comparable homes could rise in price to $700,000 next year, approach $800,000 the following year and so on, assuming no economic catastrophe. That represents a loss of a lot of buying power for those in the market for a golf home in retirement. After all, the real estate market rises independent of the stock market, and if your portfolio doesn’t keep pace…well you know the rest.

Your Primary Home Could Be Your Ticket South

There is one market scenario in which you might keep pace, or close to it, and that is if your current primary home is appreciating in price. There are a number of markets in the Northeast, for example, where prices have also appreciated in 2020 as city dwellers fled from places like Boston and New York and relocated to less densely populated areas they perceived as safer. According to my local Sotheby’s International real estate office in Avon, CT, a suburb of Hartford where my wife and I have lived for nearly 30 years, prices rose 9% between January 2020 and January 2021, to $143 per square foot; and to illustrate what a “sellers” market looks like, those who sold their homes a month ago received 98% of their asking prices, an increase of 7% over the previous January. Avon is typical of many suburbs in the Northeast and Midwest.

Self-Interest: Look Closely at Interest Rates

Finally, for those on the fence about whether to wait or go, there is a way to get a move on: Take advantage of the ridiculously low mortgage interest rates still available. A 10-year fixed rate is barely over 2%, and a 30-year rate is well under 3%. That is pretty close to “free” money, or at least as close as we are ever going to get. More important, it could provide a hedge against what many economists see as inevitable inflation, the enemy of the retiree (see sidebar). The U.S. government is going to print a lot more money to fight Covid and for infrastructure spending to stimulate employment (as well as repair bridges, tunnels and roadways.) Borrowing someone else’s money at miniscule interest rates could be an excellent hedge against inflation for retirees who want to move now.

All real estate, like politics, is local, and it is reasonable to assume prices will continue to rise in warm weather golf communities, probably faster than in places where golf cannot be played five months a year. My own confidence that prices in golf communities will continue to rise for at least the next few years is based on the sheer momentum of the numbers — the remaining millions of Baby Boomers emerging into retirement for the next 15 years; the millions of employees who will work from home into the future and seek warm weather and a more generous cost of living in so-called “Zoom Towns” in the Sunbelt; the incredibly low interest rates for those who want to use the banks’ money to pay for their homes; and the notion that, even if the economy tanks 15 minutes after you purchase your new home in paradise next month, you will still have a roof over your head — and can enjoy a feeling that, a few years from now, your home will be worth what you paid for it — and then some.

Larry Gavrich

Founder & Editor

Home On The Course, LLC

Debt Be Not Proud

Mortgage May Be Best Strategy for Retirees Seeking a Golf Home

In the face of rising prices for golf community homes and shrinking inventories, I asked a financial analyst I know to comment on the current market.

“Sometimes,” he said, “an asset is popular for a reason.”

He saw a way for those retirees intimidated by the run-up in real estate prices to forge ahead with their plans to buy. His reasoning went something like this:

Interest rates, combined with COVID, are the main drivers of higher prices. Affordability is more significant than price, and affordability is a function of a) average incomes and savings, b) price, and c) interest rates.

Rates are now near their lowest “in 5,000 years,” he exaggerated for effect. They are negative in many countries. Meanwhile, all the money being printed by central banks in the U.S. could easily send inflation higher once the economy rebounds.

How, then, should a retiree consider taking advantage of both the lowest interest rates in recorded history and the possibility of rising inflation? Consider, he advised, that a $2,000 per month mortgage payment today, at 3% inflation (a not unreasonable long-term expectation), will, in 24 years, feel like $1,000 per month in today's dollars. At 4% inflation, it will feel like $1,000 in just 18 years.

Therefore, the answer to anxiety about buying a home today may be to buy an inflation-friendly asset using long-term fixed-rate financing – that is, a house with a mortgage.

One last point: The housing market got into trouble in the 2006 to 2008 period after prices had risen way above their trend for the prior several years. Today, we have passed just the first year in which prices have risen far faster than their longer-term trend. It would take a number of years like 2020 before we face risks similar to those of the pre-recession years. By then, a couple purchasing a home today would have a substantial cushion of equity that would protect them in case of price collapse. And, of course, they would still have a nice roof over their heads in a warm and low cost-of-living environment.

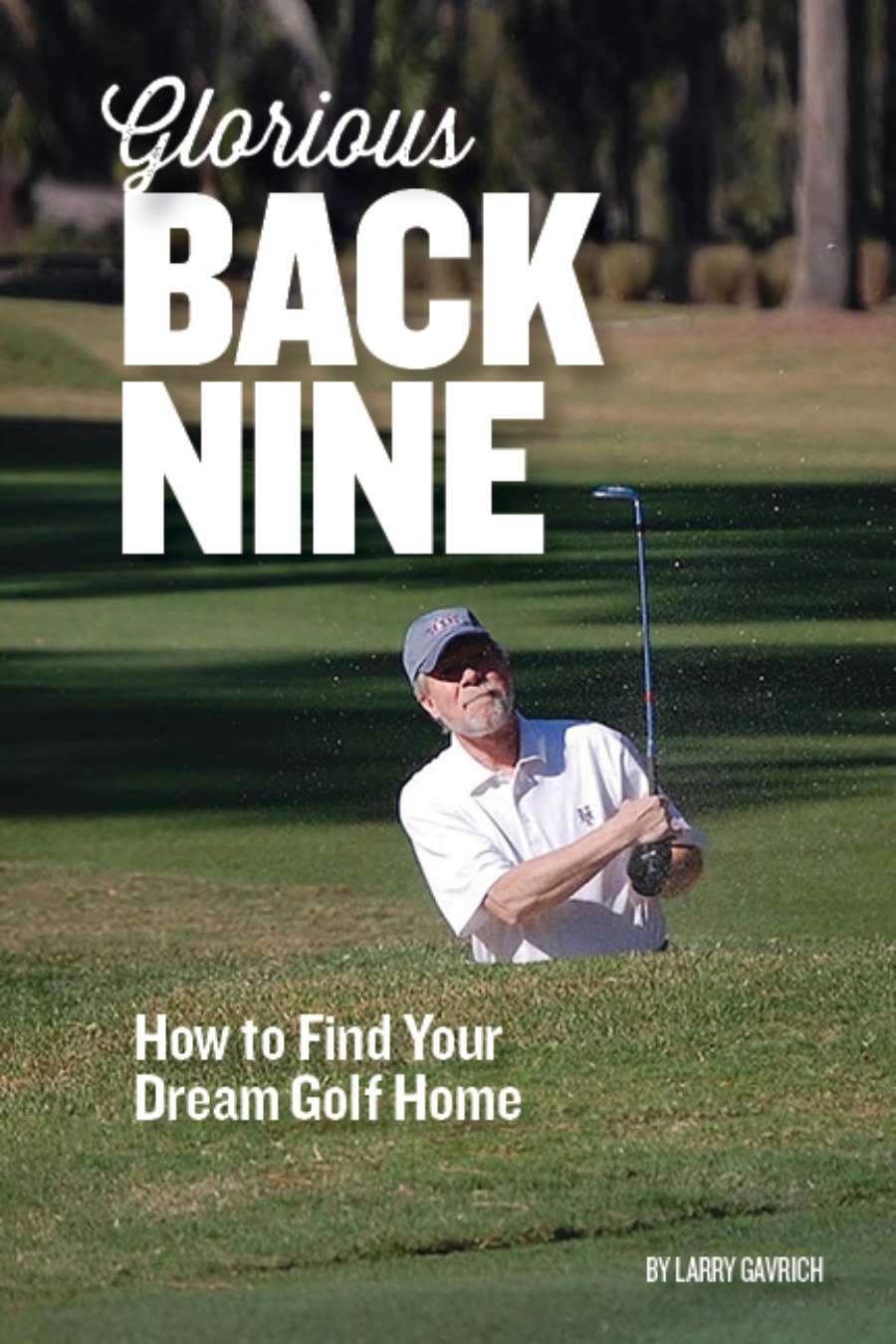

Now on Sale

Buy It Now at Amazon.com or BarnesandNoble.com.

- The only book about golf communities in the last 10 years.

- 156-page step-by-step guide to finding your dream golf home.

- Info on nearly 100 golf communities the author has visited.

- Paperback version costs less than a sleeve of Pro VIs.

Market & Communities Sales Reports

Carolina Colours developer Ken Kirkman indicated to me that his New Bern, NC, community sold eight more homes in 2020 than the year before for a sales volume increase of $4.2 million. Median price of homes sold jumped 18%, and the lowest home listed for sale, which was $290,000 in 2019, increased to $350,000 in 2020. The historical average of homes listed for sale at Carolina Colours is 12; in January (2021) it was just four.

Bluffton, SC, is home to deluxe golf communities, including Belfair, Berkeley Hall and Colleton River, all with multiple-courses and located within a few miles of each other on the highway that comes off the bridge from Hilton Head. Tom Jackson is the real estate professional I work with in Bluffton, and I asked him about inventory levels, mindful that in the post-recession period, a number of lots in those communities were priced at $0 (a result of speculation). Home sales increased from 2019 to 2020 in all three communities by impressive margins: Belfair from 40 to 69; Berkeley Hall from 18 to 49; and Colleton River from 29 to 62.

“We now have the lowest inventory [of homes for sales] in years,” says Tom. The number of homes for sale in January was nine for Belfair, five for Berkeley Hall, and six at Colleton River. Tom added that the inventory of lots for sale is dropping with the recent purchase by a builder of a group of lots in Berkeley Hall.

Real estate professionals in Pawleys Island and nearby Murrells Inlet, both south of Myrtle Beach, experienced an historic year in good and bad ways. Cathy Bergeron, our agent in Pawleys Island, reported that the median sales price for single-family homes in Murrells Inlet rose 9.7% and in Pawleys Island 9.1%. Condo prices rose more modestly in both towns but still at rates higher than in recent years. “Homes and condos are selling faster,” Cathy wrote, “and we are seeing multiple offers on properties.” Of course, the bad news is that supply is way lower than demand.

Up in the mountains in Asheville, NC, local brokerage Mosaic Realty published a report online indicating that combined fourth quarter 2020 home sales in the city of Asheville and the surrounding Buncombe County were “the highest of any year on record.” Buncombe sales for all of 2020 beat the highest numbers ever recorded by 8%. Inventory levels at the end of 2020 were extremely low, less than two months in Asheville and three months in the County for all homes listed between $100,000 and $800,000.

According to the online real estate firm Rocket Homes, the median price of a home in Wilmington, NC, increased more than 14% in 2020 to just under $300,000. Median prices for the largest homes, those with five or more bedrooms, increased a whopping 45% in the Wilmington area. Inventory of homes for sale in January 2021 was down 10.5% year over year, and those homes that were available were selling in 95 days, a drop of 39% from the 156 days a year earlier.

Rocket Homes also reported data for the hot town of Mt. Pleasant, SC, home to a number of popular golf communities and just 15 minutes over the Ravenel Bridge to Charleston. Mt. Pleasant’s median home price of $528,000 was up a relatively modest 6% in 2020. Other real estate data seemed like an anomaly for 2020, with inventory of homes for sale dropping only 4% and the average number of days it took to sell a home actually rising by a surprising 53% to 408 days. (I am wondering if that might be a mistake.)

But then there is Pinehurst, golf mecca of the east. Its reports were indicative of most other popular golf areas. According to Rate.com, price per square foot of homes sold in 2020 rose from $149 to $164, or about 9%. Homes listed for sale dropped a stunning 74%, from 208 to 54. Median home prices shot up from $480,000 to $626,000, or 30%. And by the time 2020 came to a close, it took half as many days as the year before to sell a house (71 days compared with 143).

If you are considering a search for a permanent or vacation home in a golf-oriented area, please contact me for a free, no-obligation consultation at This email address is being protected from spambots. You need JavaScript enabled to view it.

Golf community homes are on fire in the South. No, not forest fires but hot market fires, the kind that come along once in a generation when the gulf between supply and demand seems like an ocean. That is the topic this month, with some thoughts about strategies for retirees considering a move.

Golf Club of Avon, Avon, CT

Golf Club of Avon, Avon, CT

Retiree Dilemma: Which Road to Takeon the Path to Your Dream Golf Home

The famous philosopher Lawrence Berra, aka Yogi, allegedly once said that, “When you come to a fork in the road, take it.” That pretty much sums up the dilemma faced by millions of Baby Boomers and others considering a move to a warm climate with a low cost of living. The sign on one fork points “This Way.” The sign on the other says “Stop Here.” Both choices, the only two available to those who have been planning to move in retirement, involve risk.

Real Estate Market: Too Hot to Touch?

Covid-19 has had a devastating effect on the lives of millions and has pretty much thrown the world economy into a tailspin. Many businesses that depended on walk-in trade have been shuttered, and many more are on the brink. But two industries have not only survived but also, for the most part, thrived in ways they have not seen for more than a decade — the golf industry and the real estate industry.

Golf’s unique ability to provide recreation at an easily achieved social distance has made it a safe haven for golfers. And real estate sales have exploded, especially in areas at a distance from cities where the pandemic is at its most deadly and intimidating. And where golf and real estate are combined in warm and low-cost-of-living climates, homes are selling at historic levels.

A market environment in which prices in the most favored golf communities in the Sunbelt increased by double-digits in 2020 might argue for a watch and wait approach. After all, the laws of physics — and markets — say what goes up must come down. But the incontrovertible laws of real estate say also that when supply is low and demand is high, prices rise, and dramatically so when the delta between the two is wide.

Golf Communities on Fire

And boy is that delta wide as I write this. A few examples should suffice. Last year, in Murrells Inlet, SC, home to Wachesaw Plantation and other popular golf communities south of Myrtle Beach, the supply of single-family homes for sale dropped by almost 33%, and in December, just 3.3 months’ worth of homes were on the market. A six-month supply is considered “healthy” by real estate industry experts. At the Grand Harbor community on Lake Oconee in Greensboro, GA, the 13 homes currently listed for sale are about half the number typically for sale historically. A little farther up the lake at Reynolds Lake Oconee, I was surprised to see recently just seven homes listed for sale; in 2019, there were dozens. But as if to demonstrate the point that the rush is on for golf homes, another seven single-family homes at Reynolds were listed as “under contract.”

At Cypress Landing in Chocowinity, NC, Dave Grahek, a member of the marketing committee of the property owner’s association board, reported that just 10 homes were for sale in the community at the end of December compared with a five-year annual average of 28. And as I have reported before, late last year the Keowee Key community on Lake Keowee in rural South Carolina reported that many homes were selling over list price and some bidding wars had erupted. A few days ago, I noted Keowee Key listed just four homes for sale under $750,000, about 1/10th of its typical inventory.

Demand for the relatively few homes for sale in Brunswick County, NC, as local Realtor Doug Terhune put it in his February newsletter, is “on fire.” New listings across the county in just the month of December 2020 were up a decent 13.6% over same-month numbers in 2019, but units sold exploded by 45.7% to a total of 577. Average selling price was just under $372,000 and the total sales volume in the county increased an amazing 65.7%, to over $214 million — in one month. That certainly meets the definition of “on fire.”

And lest anyone think it is just the lower and mid-price ranges generating the most sales, I received a report a few days ago from Kiawah Island Real Estate indicating the island, home to some of the highest priced real estate in the South, had its “strongest year of real estate sales in [its] history.” Total sales volume on the island increased 169% over 2019 figures and, not surprising, “island wide inventory is the lowest on record.” That record goes back to Kiawah Island’s first sales in 1976.

The Fork That Says “Wait”

With prices rising rapidly in the most popular golf communities in the South, which fork in the road is a retiree or near-retiree couple supposed to take if they have been counting on a relocation to the warm South?

Waiting to see if the markets in the Sunbelt cool down is certainly a strategy, but it carries the greatest risk. The well-advertised notion that “past performance does not guarantee future results” may have you thinking those prices can’t keep rising at their current rates. A market correction must be in the offing, right? But the history of real estate market pricing shows that it will take pretty much an economic catastrophe to readjust prices enough to make waiting an effective strategy. The attached chart from the Investopedia website illustrates that; it shows only one significant (years long) interruption, from the beginning of 2007 to the end of 2011. Other than that, average real estate prices for homes in the U.S have risen pretty much in a straight line, from $19,300 at the beginning of 1963 to nearly $385,000 at the end of 2019.

If we encounter another major recession that readjusts home prices in golf communities, the financial lives of retirees planning to relocate will suffer in ways both related and not related to home affordability. (Think about the effects of a recession on IRAs or other investments that normally help fuel purchase of a retirement home.) And, anyway, if such a recession did not arrive for a few years, prices may have risen too much to retreat quickly enough for those who have waited. During the 2008 recession we saw prices across the South decrease by as much as 50%; they fully rebounded to pre-recession levels in about five years. Question for retirees who choose to wait: Do you want to wait five years just to get back to the price of a home you could purchase today?

The Fork That Says “Go”

An alternate strategy is to buy now, even if the price tag is higher than you planned — maybe even 20% higher (although buying a little less house is a viable strategy too). In golf communities I follow, the lowest-priced homes a few years ago have risen at the fastest rate generally. For example, at Reynolds Lake Oconee, homes were priced in the $200s and $300s from just after the recession until mid 2020 when the lowest level rose into the $400s. As I write this the first week in February 2021, the lowest priced home for sale not currently under contract in Reynolds is listed at $629,000, and there are only two others priced under $1 million.

If that $629,000 price follows the trend of the past few years, comparable homes could rise in price to $700,000 next year, approach $800,000 the following year and so on, assuming no economic catastrophe. That represents a loss of a lot of buying power for those in the market for a golf home in retirement. After all, the real estate market rises independent of the stock market, and if your portfolio doesn’t keep pace…well you know the rest.

Your Primary Home Could Be Your Ticket South

There is one market scenario in which you might keep pace, or close to it, and that is if your current primary home is appreciating in price. There are a number of markets in the Northeast, for example, where prices have also appreciated in 2020 as city dwellers fled from places like Boston and New York and relocated to less densely populated areas they perceived as safer. According to my local Sotheby’s International real estate office in Avon, CT, a suburb of Hartford where my wife and I have lived for nearly 30 years, prices rose 9% between January 2020 and January 2021, to $143 per square foot; and to illustrate what a “sellers” market looks like, those who sold their homes a month ago received 98% of their asking prices, an increase of 7% over the previous January. Avon is typical of many suburbs in the Northeast and Midwest.

Self-Interest: Look Closely at Interest Rates

Finally, for those on the fence about whether to wait or go, there is a way to get a move on: Take advantage of the ridiculously low mortgage interest rates still available. A 10-year fixed rate is barely over 2%, and a 30-year rate is well under 3%. That is pretty close to “free” money, or at least as close as we are ever going to get. More important, it could provide a hedge against what many economists see as inevitable inflation, the enemy of the retiree (see sidebar). The U.S. government is going to print a lot more money to fight Covid and for infrastructure spending to stimulate employment (as well as repair bridges, tunnels and roadways.) Borrowing someone else’s money at miniscule interest rates could be an excellent hedge against inflation for retirees who want to move now.

All real estate, like politics, is local, and it is reasonable to assume prices will continue to rise in warm weather golf communities, probably faster than in places where golf cannot be played five months a year. My own confidence that prices in golf communities will continue to rise for at least the next few years is based on the sheer momentum of the numbers — the remaining millions of Baby Boomers emerging into retirement for the next 15 years; the millions of employees who will work from home into the future and seek warm weather and a more generous cost of living in so-called “Zoom Towns” in the Sunbelt; the incredibly low interest rates for those who want to use the banks’ money to pay for their homes; and the notion that, even if the economy tanks 15 minutes after you purchase your new home in paradise next month, you will still have a roof over your head — and can enjoy a feeling that, a few years from now, your home will be worth what you paid for it — and then some.

Larry Gavrich

Founder & Editor

Home On The Course, LLC

Debt Be Not Proud

Mortgage May Be Best Strategy for Retirees Seeking a Golf Home

In the face of rising prices for golf community homes and shrinking inventories, I asked a financial analyst I know to comment on the current market.

“Sometimes,” he said, “an asset is popular for a reason.”

He saw a way for those retirees intimidated by the run-up in real estate prices to forge ahead with their plans to buy. His reasoning went something like this:

Interest rates, combined with COVID, are the main drivers of higher prices. Affordability is more significant than price, and affordability is a function of a) average incomes and savings, b) price, and c) interest rates.

Rates are now near their lowest “in 5,000 years,” he exaggerated for effect. They are negative in many countries. Meanwhile, all the money being printed by central banks in the U.S. could easily send inflation higher once the economy rebounds.

How, then, should a retiree consider taking advantage of both the lowest interest rates in recorded history and the possibility of rising inflation? Consider, he advised, that a $2,000 per month mortgage payment today, at 3% inflation (a not unreasonable long-term expectation), will, in 24 years, feel like $1,000 per month in today's dollars. At 4% inflation, it will feel like $1,000 in just 18 years.

Therefore, the answer to anxiety about buying a home today may be to buy an inflation-friendly asset using long-term fixed-rate financing – that is, a house with a mortgage.

One last point: The housing market got into trouble in the 2006 to 2008 period after prices had risen way above their trend for the prior several years. Today, we have passed just the first year in which prices have risen far faster than their longer-term trend. It would take a number of years like 2020 before we face risks similar to those of the pre-recession years. By then, a couple purchasing a home today would have a substantial cushion of equity that would protect them in case of price collapse. And, of course, they would still have a nice roof over their heads in a warm and low cost-of-living environment.

Now on Sale

Buy It Now at Amazon.com or BarnesandNoble.com.

- The only book about golf communities in the last 10 years.

- 156-page step-by-step guide to finding your dream golf home.

- Info on nearly 100 golf communities the author has visited.

- Paperback version costs less than a sleeve of Pro VIs.

Market & Communities Sales Reports

Carolina Colours developer Ken Kirkman indicated to me that his New Bern, NC, community sold eight more homes in 2020 than the year before for a sales volume increase of $4.2 million. Median price of homes sold jumped 18%, and the lowest home listed for sale, which was $290,000 in 2019, increased to $350,000 in 2020. The historical average of homes listed for sale at Carolina Colours is 12; in January (2021) it was just four.

Bluffton, SC, is home to deluxe golf communities, including Belfair, Berkeley Hall and Colleton River, all with multiple-courses and located within a few miles of each other on the highway that comes off the bridge from Hilton Head. Tom Jackson is the real estate professional I work with in Bluffton, and I asked him about inventory levels, mindful that in the post-recession period, a number of lots in those communities were priced at $0 (a result of speculation). Home sales increased from 2019 to 2020 in all three communities by impressive margins: Belfair from 40 to 69; Berkeley Hall from 18 to 49; and Colleton River from 29 to 62.

“We now have the lowest inventory [of homes for sales] in years,” says Tom. The number of homes for sale in January was nine for Belfair, five for Berkeley Hall, and six at Colleton River. Tom added that the inventory of lots for sale is dropping with the recent purchase by a builder of a group of lots in Berkeley Hall.

Real estate professionals in Pawleys Island and nearby Murrells Inlet, both south of Myrtle Beach, experienced an historic year in good and bad ways. Cathy Bergeron, our agent in Pawleys Island, reported that the median sales price for single-family homes in Murrells Inlet rose 9.7% and in Pawleys Island 9.1%. Condo prices rose more modestly in both towns but still at rates higher than in recent years. “Homes and condos are selling faster,” Cathy wrote, “and we are seeing multiple offers on properties.” Of course, the bad news is that supply is way lower than demand.

Up in the mountains in Asheville, NC, local brokerage Mosaic Realty published a report online indicating that combined fourth quarter 2020 home sales in the city of Asheville and the surrounding Buncombe County were “the highest of any year on record.” Buncombe sales for all of 2020 beat the highest numbers ever recorded by 8%. Inventory levels at the end of 2020 were extremely low, less than two months in Asheville and three months in the County for all homes listed between $100,000 and $800,000.

According to the online real estate firm Rocket Homes, the median price of a home in Wilmington, NC, increased more than 14% in 2020 to just under $300,000. Median prices for the largest homes, those with five or more bedrooms, increased a whopping 45% in the Wilmington area. Inventory of homes for sale in January 2021 was down 10.5% year over year, and those homes that were available were selling in 95 days, a drop of 39% from the 156 days a year earlier.

Rocket Homes also reported data for the hot town of Mt. Pleasant, SC, home to a number of popular golf communities and just 15 minutes over the Ravenel Bridge to Charleston. Mt. Pleasant’s median home price of $528,000 was up a relatively modest 6% in 2020. Other real estate data seemed like an anomaly for 2020, with inventory of homes for sale dropping only 4% and the average number of days it took to sell a home actually rising by a surprising 53% to 408 days. (I am wondering if that might be a mistake.)

But then there is Pinehurst, golf mecca of the east. Its reports were indicative of most other popular golf areas. According to Rate.com, price per square foot of homes sold in 2020 rose from $149 to $164, or about 9%. Homes listed for sale dropped a stunning 74%, from 208 to 54. Median home prices shot up from $480,000 to $626,000, or 30%. And by the time 2020 came to a close, it took half as many days as the year before to sell a house (71 days compared with 143).

If you are considering a search for a permanent or vacation home in a golf-oriented area, please contact me for a free, no-obligation consultation at This email address is being protected from spambots. You need JavaScript enabled to view it.

Golf Club of Avon, Avon, CT

Golf Club of Avon, Avon, CT